28 Oct Investing In Your Future by Mike Noel

In thinking recently about the upcoming publishing of our new book, Your Personal Career Coach: Real-World Experiences for Early Career Success, it hit me that many of our readers will be receiving diplomas early in 2019. That led me to ponder the early career moves they might be considering. A few months ago, an important development suddenly became a hot topic in the U.S. and even in the world. That development was a substantial increase in stock market values, followed by a quick and steep decline in those values. Panic was beginning to swell, and some friends of mine were rattled because of it. They asked me if I thought they should sell their stocks ASAP.

Allow me a minute to interject that I’m not an investment specialist…not even close to it. Although I majored in business in my college days and was the Chief Financial Officer of a large corporation, I’ve never been in the business of giving financial advice for a living. But I’m proud to say the financial plan I initiated at the time of my first job…a plan for my own financial well-being and that of my wife and our two small children…has turned out quite well for me over these many years.

My plan was to have my employer take 5-10% out of my paycheck each week for investment in the Company’s 401K Plan. Deciding how I would invest that money in the Plan would be done with some assistance and recommendations by investment professionals managing the 401K plan. I set it up that way because I didn’t want to assume the high risk of trading stocks or speculating on them.

Throughout the several years that followed, the stock market went up in value at times, and it went down at times. But thankfully, over time, the amount of upside in the stock market significantly outweighed the downside. So, between my promotions and watching the stock values rising in the 401K Plan, I was able to enjoy the value of my investments in the 401K Plan and still have some spending money left over. Thanks to that, I have had the benefit of living my life virtually free of financial worry.

So, to get back to my friends, I suggested they not sell their shares because, over time, the market has always increased in value. Many people don’t realize that, if you sell your shares, but the stock market soon afterward rises, it’s really hard to know when to get back into the market. I know a few people who never got back in, and they are not sure what to do now.

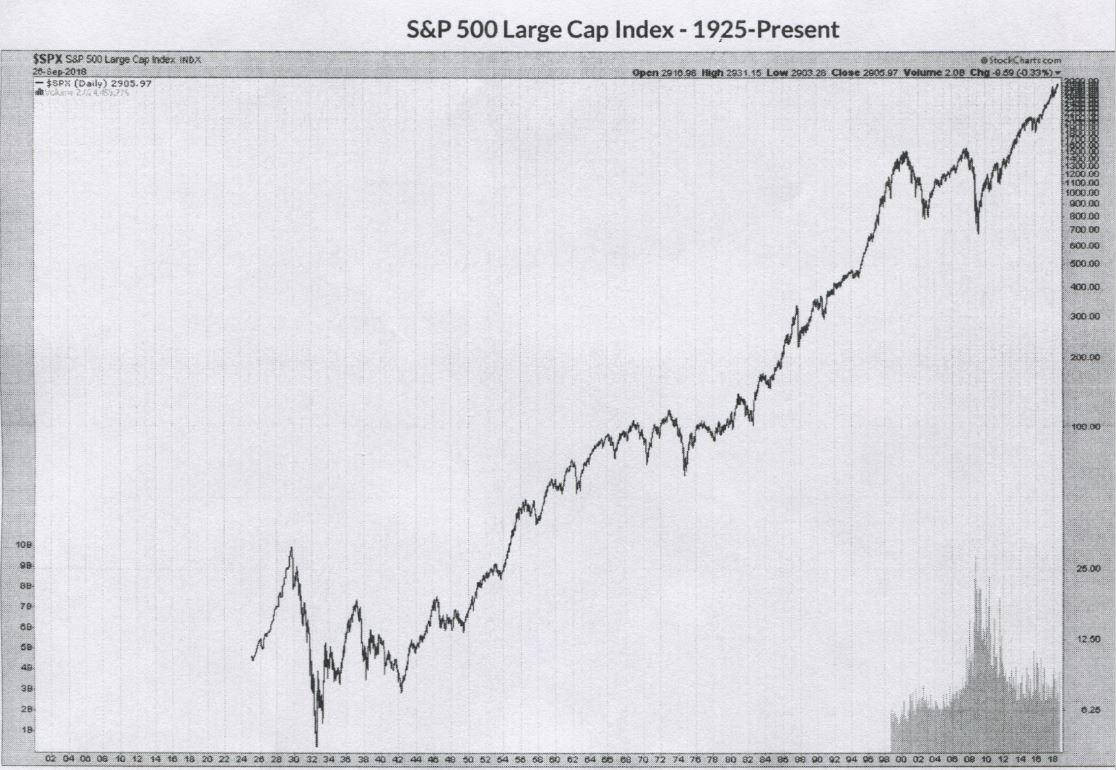

If you happen to get into the stock market just as the market begins to decline, will you be willing to stay the course? If you are not willing to do that, the stock market probably isn’t for you. (Please see the chart on the last page of this blog where you will be able to notice the ups and downs in the stock market over the past 93 years.) If you had invested in it in 1925, and then watched the stock market take a huge drop for the next 7 years, would you have had enough courage to stay the course? Many people did not. But think how disappointed you would be today if you had worried about a prolonged dip in the stock market and sold all of your shares at that time, which happened to be just at the wrong time; the time when the stock market was about to rise again.

There is no guarantee that a large and prolonged downturn in the stock market won’t happen, but if you’ve saved enough money over the years by investing that 5-10% you take out of your paycheck and have purchased more shares than usual because of the depressed prices, you will eventually come out way ahead, as the chart shows.

If you don’t have access to a 401K Plan, my suggestion is to do some research on companies that specialize in guiding people as to how to invest in stable, successful investment plans. If they have good investing records and a good reputation, along with low costs, give them a try over several months to see if you are comfortable with them. And then meet with them a few times each year to see if you continue to be satisfied. If you aren’t, be sure to use the same search process you’ve learned and find another investment company you can count on.

You don’t have to “shoot the moon” with your investments. Just place your savings with a good, solid investment advisor who can help you develop a retirement plan, and then continue the discipline of investing 5-10% of each paycheck, and watch your money grow slowly but surely.